Andrea Brambila for Inman News: Bombshell multibillion-dollar commission suit now a class action

“In a serious blow to the National Association of Realtors and major real estate franchisors, potentially millions of homesellers can ask to be reimbursed for billions in commissions they paid to buyer agents between 2015 and 2020 as a result of a federal court ruling on Wednesday.”

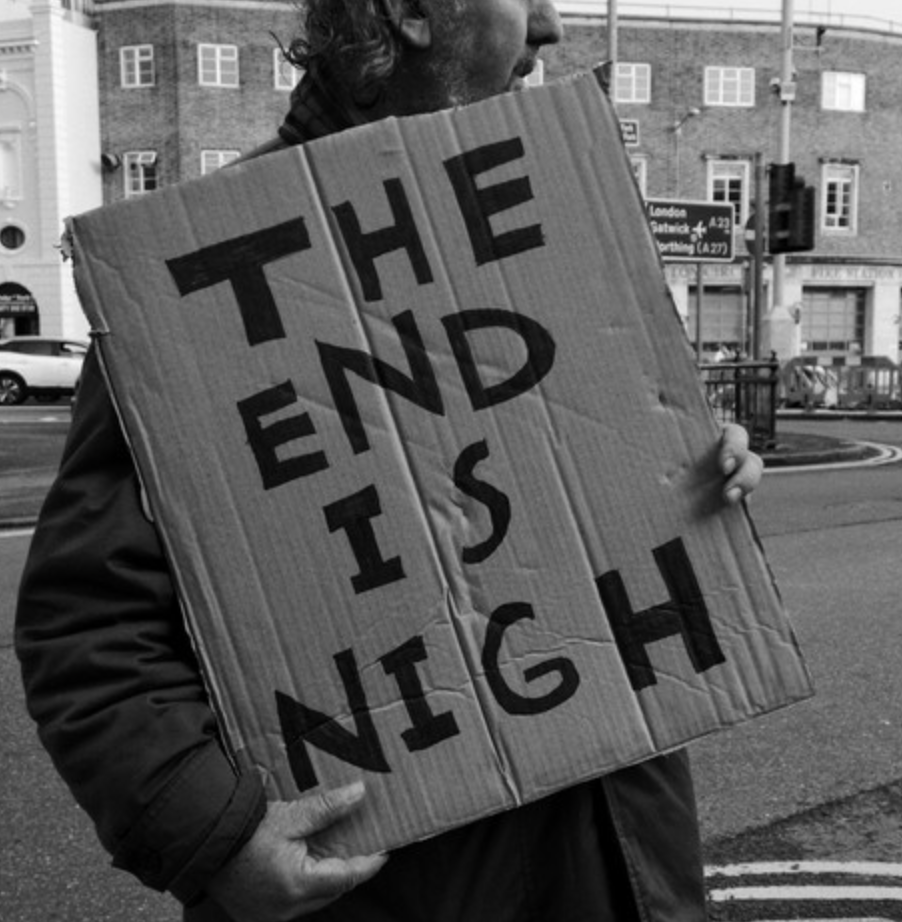

Welp, here we go. I’ve been holding off writing about this in the hopes I come up with some sort of positive spin. But I don’t have one. After reading the judge’s memo, it seems she has her mind made up. And I’m afraid all the nuances of our business are going to be lost to someone who wants to take the advice of someone who says…

“…in more competitive markets, the increasing use of the internet has reduced consumer costs, highlighting how increases in the number of consumers using the internet to book air travel and to trade stocks has been accompanied by corresponding decreases in commissions for travel agents and stockbrokers.”

Buying a house ≠ Buying a plane ticket

Buying a house ≠ Buying a stock

And Zillow can’t smell the cat.

The classes have been certified. That train has left the station. Yes, one could appeal, but to my eyes this judge made no legal error and an appeal must be based on the law not on some assertions of so called “facts.” So what happens? 98% of class action suits are settled once a class has been certified. Trial is very expensive and the risks to the defendants are huge. If they lose, they each or collectively are likely out of business. Note, he who settles first settles best (ie cheapest). The industry needs to adjust to a new reality: the process being challenged (seller is perceived to determine buy side fees) is on its deathbed. DoJ has already filed a statement of interest and is likely to be a keen watcher of how these defendants co-ordinate their response (since such coordinated activity could give rise to yet another anti-trust action). The time has come for some creative settlement negotiations.

f I ran NAR, I would file for bankruptcy and make the monetary consequences of this lawsuit go away. NAR holds considerable assets (including its investment arm) all of which are at risk. The more NAR fights on so-called “principle,” the worse the likely outcome in terms of monetary impact. One or more of the other defendants will be tempted to sell NAR down the river since they are in a position to trade monetary damages for pressure on NAR for rules reform. Further, NAR might worry about their own members filing a class action suit re violation of fiduciary responsibility in administering dues and assets. NAR in its present form has now met its “use by” date and that date is rapidly approaching.

I hear the Big Z is working on that smell-a-vision thing…

Was good to see you at Turn On, Greg. Far too briefly, but good.

Greg, I love hearing and reading your posts/podcasts. It has become a highlight of my day. I couldn’t agree more; they are comparing apples and peanuts here.

Hmm, isn’t the end always nigh for us for one reason or another? It’s been a while, but I read through the Moehrl complaint again. It can be amusing to read through. I found it interesting that by my count, Co-Conspirators is found 18 times Conspiracy is found 34 times. I’m not an attorney and I don’t play one on TV. It seems to me that proving conspiracy through all of the defendants will not be an easy task. Obviously, the industry should prepare for the worst but I don’t think this is a slam dunk for the prosecution as many pundits have been claiming.

I also found this particular paragraph in the complaint amusing in that it doesn’t age well being that commission compression is a fact of life now. The “diminishing role” was rather cute as well. Try telling that to buyer agents over the last two years and currently.

8. Defendants’ conspiracy has kept buyer broker commissions in the 2.5 to 3.0 percent range for many years despite the diminishing role of buyer brokers. A majority of home buyers no longer locate prospective homes with the assistance of a broker, but rather independently through online services. Buyer brokers increasingly have been retained after their client has already found the home the client wishes to buy. Despite their diminishing role, buyer brokers continue to receive 2.5 to 3.0 percent of the sales price due to Defendants’ conspiracy.