An Interview with Zillow CEO Jeremy Wacksman About Evolving Strategy

“This week’s Stratechery Interview is with new Zillow CEO Jeremy Wacksman. Wacksman is a long-time Zillow employee, having joined the company in 2009, three years after its founding. We also have a lot in common, including working at Microsoft after an MBA at Kellogg (we went in rather different directions since then!). Wacksman was previously COO of Zillow, and before that was CMO.”

Ben Thompson is the founder of Stratechery, which is one of my favorite technology blogs. Ben had previously interviewed Zillow co-founder and former CEO, Rich Barton. Barton has cited Ben’s writing about Opendoor as one of the reasons Zillow went in to iBuying. I would recommend listening to the interview via the Stratechery podcast. Access might require a subscription, which I highly recommend.

This is a great interview and really covers a lot of subjects including Jeremy’s background, Zillow’s early history, its business model evolution, its launch and then quick exit out of iBuying. But these three sections caught my attention. First is his thoughts his “pitch” on their upcoming “Super App”

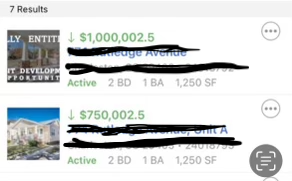

“Well, give the Super App pitch. What is the overarching strategy, the shift away being an ads business to what you’re doing today?

JW: Yeah, the Super App pitch is that if I could give you a remote control on your phone so that the same way you can order an Uber or book an Airbnb, you could do all of your real estate transaction inside of the Zillow app. You could talk to your loan officer and your agent 24/7 via group chat. You could understand via a pizza tracker where your loan is and are you missing any documents and it could all be in one place.”

I have some thoughts on this I’ll save for a later post.

The other is about the impact of the NAR Settlement.

Give us the overview, you’re the expert.

“JW: The two high level changes are both about buyer and seller choice and education.

…..So in both cases, on the seller side, on the buyer side, it’s a more empowered customer, and it’s a more educated customer and we can come back to what we’re doing, we’re leaning into that education. On the buy side, we are innovating a touring agreement, like a dating form because we want to help educate customers before they get married to an agent. Well, what are you going to get into? What should you expect? What should a contract look like? And help them be informed about their choice before they make it, so that’s what changing.”

I like the analogy of a “dating form”.

And lastly on the fate of the MLS.

“JW: Our argument is again, we’re here for the customer and there is some real good in this marketplace and you can build a lot of good and we can grow our company really big in a world where there is listing sharing and there are all these benefits and all these things we are doing to grow our company to — you’d move back to a classified business model which isn’t really good for the buyer and the seller. So that’s the big part of why we’re like — but it was this weird argument where we’re talking to investors about like, “Well, yeah, the margin profile of that business might look better, Zillow would probably win more, but we don’t actually think that’s good”, it’s not really good for anyone. It’s definitely not even good for the suppliers who would in theory, enact it.”

Bravo.